In the bustling landscape of Indian finance, one name shines bright – Bajaj Finance Limited. As a premier non-banking financial company (NBFC), Bajaj Finance has carved a niche for itself with its diverse product range and extensive nationwide presence. Let’s take a closer look at what sets Bajaj Fin apart, its strategic approach, and the plethora of offerings it brings to the table.

A Legacy of Empowerment:

Founded in 2007, Bajaj Finance emerged from the esteemed Bajaj Finserv group, a conglomerate renowned for its diverse financial services. At its core, Bajaj Fin champions financial inclusion, aiming to empower individuals across all income brackets to achieve their financial dreams.

Several strategic pillars underpin Bajaj Fin’s prominent position in India’s NBFC market:

- Diversification: Bajaj Finance boasts a comprehensive suite of financial products, ranging from consumer durables financing to personal and SME loans. This diversification mitigates risk, ensuring stability across various segments.

- Consumer Durables Focus: The company has excelled in consumer durables financing, forming strategic partnerships with leading retailers and manufacturers. This collaboration facilitates seamless loan access at the point of purchase, driving sales and fostering mutual growth.

- Rural Outreach: Recognizing the immense potential in rural India, Bajaj Fin has expanded its footprint beyond urban centers. This strategic expansion taps into new customer segments, fueling overall growth and fostering financial inclusion.

- Customer-Centric Approach: Building enduring customer relationships is a cornerstone of BajFin’s ethos. By offering flexible repayment options, transparent processes, and prioritizing trust, the company ensures customer satisfaction and loyalty.

- Technological Innovation: BajFin harnesses the power of technology to streamline operations and enhance reach. From digital loan applications to data analytics, technology drives efficiency and personalized service delivery.

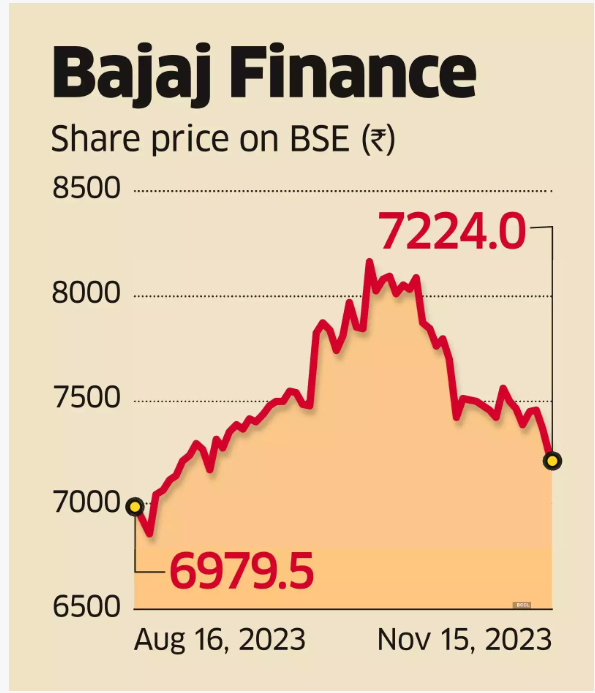

The current price of BajFin is around 7175 and 7000 was a phycological resistance which has become a good support now. The nearest target is 7600-7700 and if sustained there then it will move towards its previous highs, which is above 8000 mark.

Bajaj Finance’s product repertoire caters to diverse customer requirements:

- Consumer Durables Financing: Easy installment options make purchasing appliances, electronics, and furniture a breeze.

- Two-Wheeler and Three-Wheeler Financing: Facilitating access to convenient transportation solutions through flexible financing options.

- Personal Loans: From debt consolidation to medical emergencies, personal loans cater to various financial needs.

- SME Loans: Small and medium enterprises find tailored solutions for business expansion and working capital requirements.

- Commercial Lending: Bajaj Finance caters to larger businesses with bespoke commercial lending solutions.

Beyond Lending: A Holistic Financial Ecosystem

Bajaj Finance transcends traditional lending boundaries, offering additional services like:

- Bajaj Finserv Direct: A digital platform providing seamless access to a wide array of financial products and services.

- Bajaj Allianz Life Insurance: Partnering with Allianz, Bajaj Finance offers life insurance products, ensuring holistic financial security for customers.

Looking Ahead: Charting a Path to Progress

The future holds promise for Bajaj Finance, with key areas of focus including:

- Rural Expansion: Continued penetration into rural markets to reach untapped customer segments and drive financial inclusion.

- Digital Transformation: Intensifying efforts to leverage technology for enhanced efficiency, personalized offerings, and superior customer experiences.

- Product Innovation: Exploring new product categories and financial solutions to meet evolving customer needs and market demands.

In Conclusion: A Beacon of Financial Empowerment

Bajaj Finance’s unwavering commitment to financial inclusion, coupled with its diversified product portfolio and strategic approach, solidifies its position as a leader in India’s NBFC landscape. As the company continues its journey of innovation and expansion, Bajaj Finance remains steadfast in its mission to empower individuals and businesses across India in realizing their financial aspirations. Remember, before embarking on any financial decisions related to Bajaj Finance or any other NBFC, thorough research is imperative.