The Federal Reserve, often called the “Fed,” is like the financial guardian of the United States. Think of it as a big bank that looks out for the country’s money and tries to keep things stable. When ever we see interest rates Fed comes in our mind.

Why Does the US Federal reserve exist?

The Fed has two main jobs: making sure as many people as possible have jobs, and making sure prices for things don’t go up too fast. It’s like a balancing act to keep the economy in good shape.

How Does the US Federal reserve work?

The Fed has tools it uses to do its job. One important tool is the federal funds rate, which is like the interest rate that banks charge each other. By changing this rate, the Fed can make it easier or harder for people and businesses to borrow money. When times are tough, they might make it cheaper to borrow. When things are going too well and prices might go up too fast, they might make it a bit more expensive to borrow.

The Fed also does something called “open market operations.” This is like buying and selling things, but instead of clothes or gadgets, it’s government IOUs. When the Fed buys these IOUs, it’s like putting more money into the system, making it easier for people to borrow. If they sell them, it’s like taking some money out, making it a bit harder to borrow.

Helping Out in Tough Times:

When there’s a big financial crisis, the Fed can do special things to help the economy get back on its feet. In 2008, during a tough time, they did something called “quantitative easing,” which is a fancy way of saying they pumped a lot of money into the system to keep things from falling apart.

Being Independent and Responsible:

The Fed works independently, which means it’s not influenced by politicians who might want quick fixes. This is good because it lets the Fed make decisions based on what’s best for the economy in the long run. But, they’re not a secret club – they report to Congress and get checked regularly to make sure they’re doing a good job.

Why Does the World Care for Fed interest rates?

What the Federal Reserve does doesn’t just affect people in the U.S.; it can impact the whole world. Changes in interest rates can make money move around globally, affecting how much things cost and how well other countries are doing economically.

Understanding the Fed is like understanding the captain of a ship. They have tools to keep the ship steady, like adjusting the sails when there’s too much wind or not enough. As we sail through 2024, the Fed’s decisions will guide the ship of the economy, affecting how easy it is for you to get a loan, find a job, and even how much your everyday things cost. Next up, we’ll look at what the economy looks like right now and how the Fed might steer us through the year.

The fed funds rate remains at a range of 5.25% to 5.5%.

The Federal Reserve has left interest rates unchanged in January 2024. It’s the fourth consecutive time that the central bank has decided to keep steady on rate policy.

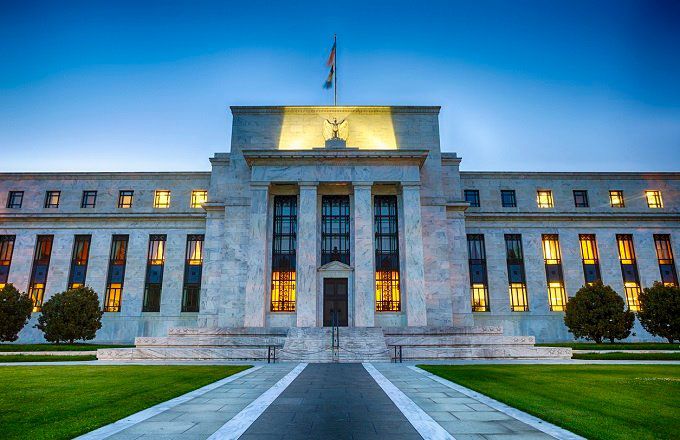

Picture image credit: CNN

The Federal Reserve Decision: Unchanged Rates and a Shift in Tone

Wednesday’s Federal Open Market Committee (FOMC) meeting held the financial world’s attention, and as the dust settles, we unravel the key takeaways that shape the economic landscape for the coming months. The Federal Reserve, led by Chair Jerome Powell, opted to keep interest rates unchanged at 5.25% to 5.5%, maintaining this stance for the fourth consecutive meeting, aligning with expectations.

The Unchanged Rates and a Notable Omission

The decision to leave interest rates unchanged was widely anticipated, but a subtle yet significant change was observed in the FOMC’s statement. The phrase “additional policy firming” was conspicuously absent, signaling a departure from the previously hawkish stance. This omission raised eyebrows and hinted at a potential shift in the Fed’s approach. However, the Fed introduced a new sentence emphasizing that a rate cut won’t be considered until there’s “greater confidence that inflation is moving sustainably toward 2%.” This nuanced alteration became a focal point of discussions.

Curbing Expectations for a March Rate Cut:

Analysts and investors had been speculating about the possibility of a rate cut in March. However, Powell’s press conference poured cold water on these expectations. Powell expressed skepticism about a March rate cut, citing the need for more assurance regarding inflation trends. He acknowledged the positive trajectory of recent inflation data but maintained caution, emphasizing the importance of sustained positive signals. While a March cut is not entirely off the table, Powell’s remarks suggested a preference for a more cautious approach.

Powell’s Cautious Tone:

Throughout the press conference, Powell struck a cautious tone, highlighting the gravity of the decision to alter interest rates. He underscored the consequential nature of such a move, pointing to the unpredictable nature of economic data. Powell’s caution stems from the potential impact on the broader economy and financial markets. The Fed’s actions have far-reaching implications, and Powell’s measured language conveyed a sense of deliberation and prudence.

Balancing Act on the Balance Sheet:

In a notable development, Powell disclosed that policymakers initiated discussions on when to start slowing the pace of their balance sheet runoff, also known as quantitative tightening. While no immediate decisions were made, Powell hinted at a more in-depth conversation on this matter scheduled for March. The balance sheet has been a key tool for the Fed, and any adjustments could have ripple effects on financial markets and the broader economy.

Market Responses and Volatility: As Powell addressed the media, the financial markets experienced a rollercoaster ride. US stocks showed volatility, swinging between session highs and lows. The S&P 500 witnessed a decline of over 1%, reflecting the uncertainty and interpretative challenges posed by the Fed’s nuanced statements. Bonds, on the other hand, saw mixed reactions, and the dollar gained strength while gold prices dipped.

As we navigate the financial landscape post-FOMC meeting, the key takeaway is the Fed’s evolving stance. While maintaining interest rates, the central bank signals a nuanced shift, emphasizing a data-dependent approach. The absence of a commitment to further tightening and the potential discussion on the balance sheet add layers of complexity to the future path of monetary policy. The markets will keenly observe incoming economic data, especially inflation indicators, as they seek clues regarding the Fed’s next moves. Powell’s cautious demeanor reflects a central bank carefully weighing its decisions amid a complex and ever-changing economic backdrop.

In conclusion, the FOMC meeting and Powell’s press conference provided insights into the Fed’s current thinking, injecting a dose of uncertainty into the markets. As we move forward, market participants, economists, and everyday investors will closely monitor economic indicators and the Fed’s communications for cues on the trajectory of interest rates and broader monetary policy. The delicate balancing act between economic stability and growth remains at the forefront of the Fed’s considerations, shaping the financial narrative in the months to come.