Prices at the grocery store and gas pump might be offering some relief, but overall US inflation nudged higher in January, driven by stubborn rent and housing costs. Let’s break down what it means for everyday people and the Federal Reserve.

Prices Creep Up, But Stay Above Target:

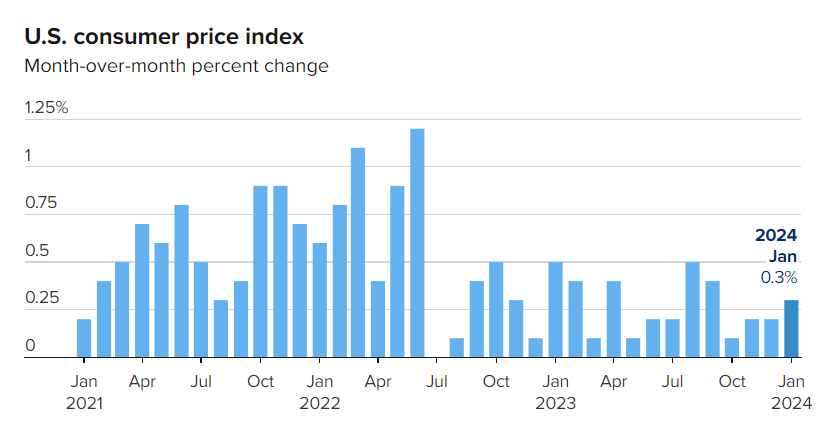

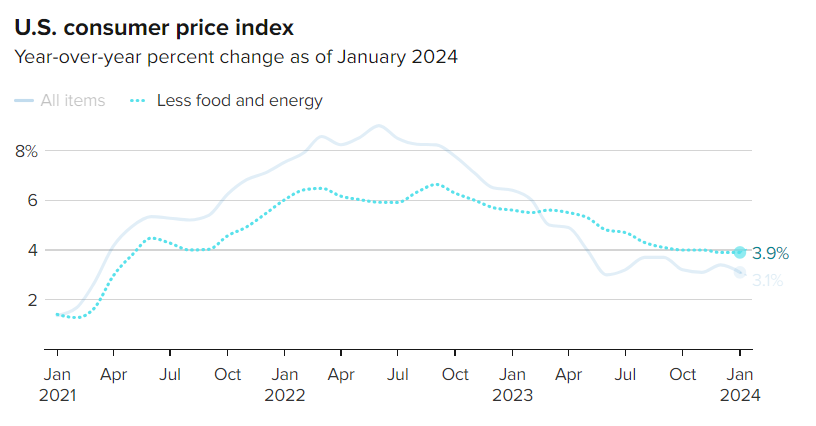

Imagine a shopping basket filled with everything you buy – food, rent, clothes, gas. The Consumer Price Index (CPI) tracks how much that basket costs over time. In January, it went up 0.3% compared to December, translating to a 3.1% annual increase. While that’s down from December’s 3.4%, it remains above the Federal Reserve’s 2% target.

Economists Expected Less Pain but US CPI data surprised experts

Experts predicted a slightly smaller monthly bump of 0.2% and an annual increase of 2.9%. Their surprise reflects the stickiness of inflation, particularly in housing costs.

Shelter Costs: The Big Culprit

Think rent, mortgages, utilities – they make up roughly a third of the CPI basket. This category jumped 0.6% in January, contributing heavily to the overall inflation rise. On a yearly basis, shelter costs increased a hefty 6%.

Despite hopes for a slowdown, overall prices climbed in January, driven primarily by unexpected increases in hotel and motel costs. While rent and homeowner equivalent rent (OER) saw some increases, they weren’t the main culprits for this month’s rise.

According to Brad Case, chief economist at Middleburg Communities, “Shelter costs went up, but not necessarily due to rent. The hike was mainly driven by hotels and motels, which haven’t been a significant issue in the past year, but spiked in January.”

However, Case also sees a silver lining: “This strong demand across all housing segments reflects a robust economy. Unfortunately, it also suggests that interest rates won’t decrease aggressively or quickly.”

In short, while some relief was expected, inflation remains stubborn, fueled by unexpected factors like hotel pricing. This reinforces the notion that economic strength might delay anticipated interest rate cuts, potentially impacting wallets and budgets for longer.

Food and Energy: A Mixed Bag

Groceries saw a 0.4% monthly increase, but thankfully, some items offered relief. Ham prices, for example, dipped 3.1%, while egg prices scrambled 3.4% higher (sorry, couldn’t resist the pun). Energy prices actually helped temper inflation, falling 0.9% thanks to a 3.3% slide in gasoline prices.

Stock Market Jitters:

The news sent shivers down the spines of investors, with stock market futures dropping sharply and Treasury yields (interest rates on government bonds) climbing higher.

Remember how prices are rising? Even though hourly wages rose 0.3% in January, when you adjust for inflation, they actually decreased slightly. This means the “real” purchasing power of your paycheck (what it can actually buy) might feel a bit lower.

The Fed wants to balance keeping prices stable with supporting economic growth. This “hotter than expected” inflation report throws a wrench in their plans. While some market observers hoped for quicker interest rate cuts, the Fed might need more data before easing their grip on monetary policy.

The Fed expects inflation to cool down, partly due to a slowdown in housing costs. However, January’s rise throws a curveball at their predictions. This could complicate their attempts to loosen the reins on monetary policy.

Before the CPI report, markets expected the first rate cut in May, potentially followed by five more throughout 2024. Now, the Fed might favor fewer cuts, with some officials suggesting two or three might be more likely.

Beyond housing, it’s a mixed bag. Used car prices dropped 3.4%, clothes became 0.7% cheaper, and medical supplies saw a 0.6% decline. However, electricity bills rose 1.2% and airline fares climbed 1.4%.

While some price relief exists, inflation remains above target, particularly driven by housing costs. This complicates the Fed’s balancing act, potentially delaying anticipated interest rate cuts. Remember, even if inflation slows down, it doesn’t mean prices are falling – they’re just rising more slowly. So, keep an eye on your budget and adjust as needed to navigate this dynamic economic landscape.