XRP Prepares for a Second Attempt: Can it Break Through Resistance?

Ripple & Ethereum are the two top cryptos according to the coin market cap. Hold on to your hats, XRP hodlers! The past week has been a rollercoaster ride for Ripple’s native token, with a surge towards new highs followed by a slight pullback. Let’s delve into the recent price action and analyze what the future might hold for Ripple & Ethereum.

Reaching for the Top: A Brush with Resistance

As of today (date of writing), XRP is hovering around $0.62. This comes after a strong showing earlier in the week, where it climbed to nearly $0.7440 on March 11th. This surge brought XRP face-to-face with a significant resistance level – $0.71510. This hurdle has proven challenging in the past, as evidenced by two rejections in November 2023.

For more: watch and take reference from the last weekly chart of XRP

Retracement and Reattempt: A Sign of Resilience?

The recent pullback from the resistance zone might seem discouraging, but it’s a natural part of price movement. A retracement, a temporary dip in price, often occurs before another attempt to break through resistance. In XRP’s case, the support level at $0.58514 seems to have played a crucial role, preventing a more significant drop. This could be interpreted as a sign of underlying strength, suggesting a potential rally back towards the $0.71510 resistance.

Looking Ahead: What to Watch Out For

While the technical indicators are hinting at a possible bullish breakout, it’s important to remain cautious. Here are some key factors to keep an eye on:

- Market Sentiment: Broader market trends and investor confidence can significantly impact XRP’s price. Positive developments surrounding Ripple’s ongoing lawsuit with the SEC could fuel another surge.

- Technical Indicators: Closely monitoring technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide further insights into potential price movements.

- Breaking Resistance: A decisive break above the $0.71510 resistance level would be a significant bullish signal, potentially paving the way for further price increases.

Here we will be analyzing Ripple & Ethereum both so lets talk about Ethereum now.

Breaking Down the $4,000 Barrier: A Technical Analysis of Ethereum

For more : take reference from our last eth analysis.

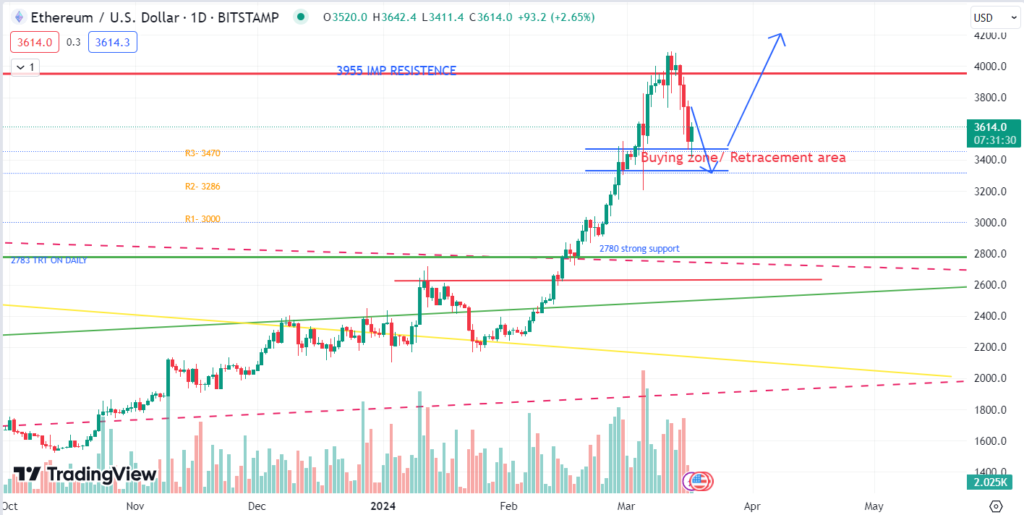

In the dynamic world of cryptocurrency, Ethereum remains a focal point, with today’s price resting at $3614. Reflecting on recent trends, Ethereum soared to a notable high of $4095, a level that served as a formidable resistance, particularly in the vicinity of $3955. However, despite initial excitement, Ethereum struggled to maintain its position and retraced back towards crucial support levels, finding solace near $3470 and $3286.

This retracement isn’t just a setback; it’s an opportunity for savvy traders. At $3470 and $3286, Ethereum enters what many consider a buying zone, offering a chance for a potential bounce back. These levels represent critical support thresholds, acting as springboards for Ethereum’s price to regain momentum and resume its upward trajectory.

Understanding the significance of these price levels is essential for navigating Ethereum’s weekly analysis effectively. While $4095 showcased Ethereum’s potential, the inability to sustain at this level underscores the importance of identifying both resistance and support zones. In this case, $3955 proved to be a tough nut to crack, prompting a retreat towards lower price regions.

For traders, recognizing buying opportunities amid retracements is crucial for maximizing returns and managing risks. By strategically positioning themselves within these support zones, traders can capitalize on Ethereum’s resilience and potential for a rebound. However, prudent risk management practices are imperative, as market dynamics can swiftly change, warranting a cautious approach.

Looking ahead, Ethereum’s weekly analysis presents a mix of challenges and opportunities. While recent retracements may dampen short-term enthusiasm, they also pave the way for potential upside movements. As Ethereum consolidates around key support levels, traders can monitor price action closely, seeking confirmation of a bullish reversal before committing to new positions.

In summary, Ethereum’s weekly analysis highlights the importance of discerning both resistance and support levels in navigating the cryptocurrency market. Despite encountering hurdles near $3955 and $4095, Ethereum’s retreat towards $3470 and $3286 offers a promising buying opportunity for traders looking to capitalize on potential rebounds.

Remember: This information is for educational purposes only and should not be considered financial advice. Always conduct your own research and consider your risk tolerance before making any investment decisions.